By Saad Ibrahim, P. Eng.

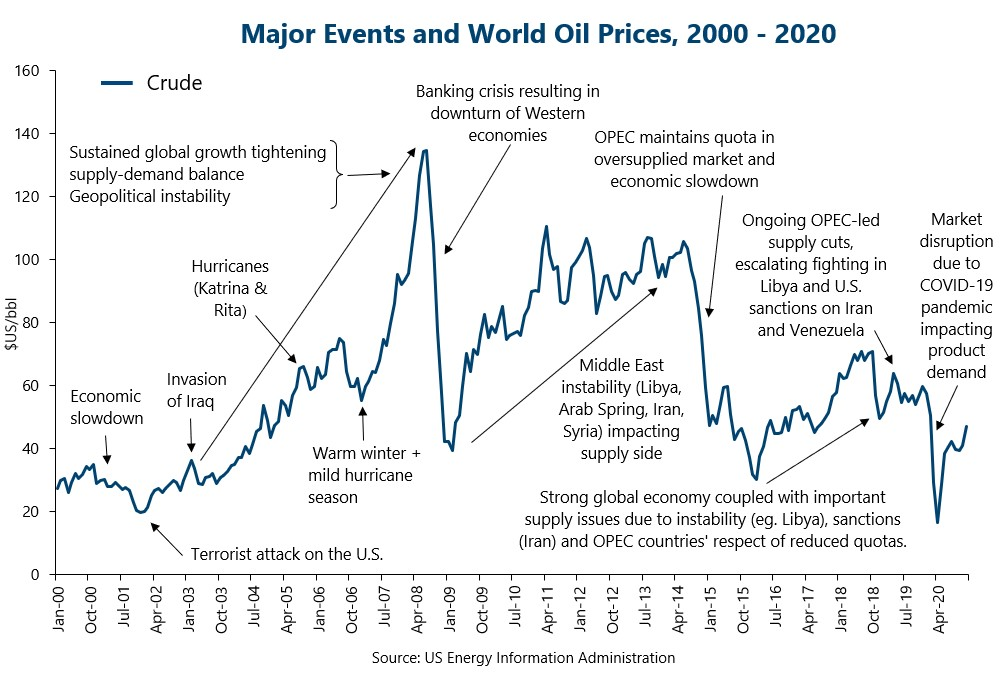

The price of oil has been the most volatile in all commodities, because of various reasons, including economics, political, war situation, health (Corona epidemic), etc, as shown historically in the graph below.

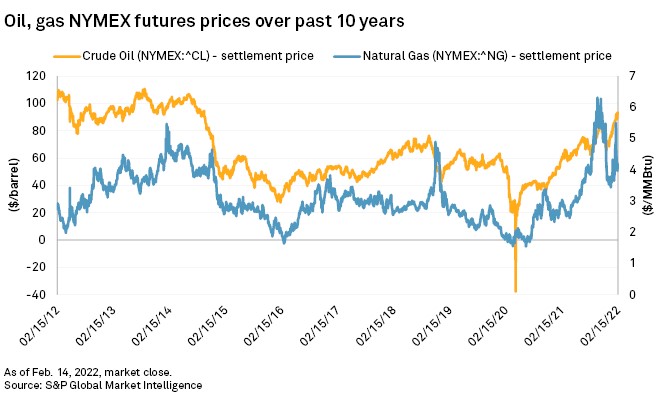

However, since the last few months, the supply and demand balance has changed as the world economic recovery is moving forward, resulting in a major spike in the price of oil and natural gas, as shown in the graph below.

The major and unexpected increase of oil and natural gas prices has resulted in record profits for the oil industry. This unpredictable change in the oil/gas prices has caused confusion on how the oil industry will deal with healthy cash flow and record profits. The oil companies are at a cross-road on how to plan future activities. There are always a few options available, including:

- Option 1: Keep activities flat and not invest in the industry i.e freeze staff hiring, limit drilling, and production optimization expenses. Focus more on paying-off debts, buying back the undervalued stocks; pay more dividends to the shareholders. This option will limit future growth and long-term benefits.

- Option 2: Take advantage of the record cash flow and reinvest into exploration and drilling to secure future reserves increase and also invest in production optimization efforts of existing producing fields (low hanging fruit). Further, invest in hiring and training staff which will yield even more profits to the industry.

We at Petro Management Group (PMG), strongly support option 2, and we have the following tools, and experience to help the oil companies optimize production, including:

- The use of well testing (PTA techniques) to determine reasons for poor good preformation and make recommendations to maximize production.

- The use of Rate Transient Analysis (RTA) to evaluate the performance of Multi-Stage Frac of Horizontal Wells (MFHW’s), to evaluate the efficiency of frac treatments, optimum well spacing, and prepare production forecast sensitivity analysis.

- Evaluate the feasible EOR applications for tight/unconventional reservoirs

- Provide a wide range of training courses to enhance the skills of the technical staff

- The use of Mini Frac (DFIT) to optimize frac design and benefits

For more information on our consulting and training services, please visit our web site: www.petromgt.com or Saad Ibrahim at email saad@petromgt.com or cell: (403) 616-8330